Despite a Decade of Promises, PayPal Remains Out of Reach for Bangladesh's Freelancers

PayPal, the U.S.-based global online payment processor, enables transactions in over 25 currencies across more than 200 countries. Yet, despite repeated promises, Bangladesh remains excluded from its core services—a frustration that has lingered for nearly a decade.

The journey toward bringing PayPal to Bangladesh began in 2015, followed by a formal agreement with Sonali Bank on July 15, 2016. Hopes soared in October 2017 when, during the Digital World expo, the government announced PayPal’s launch. However, it was not PayPal’s primary service that debuted, but rather its subsidiary, Xoom—limited to inbound remittance only.

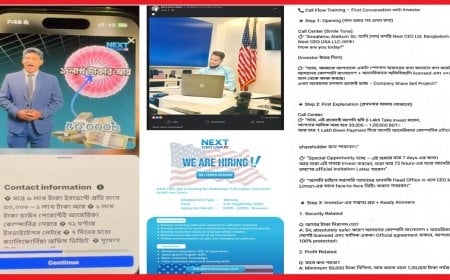

This narrow functionality disappointed many freelancers who rely on platforms such as Fiverr, Upwork, and Freelancer.com. Due to PayPal's absence, withdrawing earnings directly has become difficult, prompting many to resort to risky alternatives like using foreign PayPal IDs, gray-market exchangers, or purchasing PayPal dollars from third-party services like EasyWayBD. These workarounds often violate PayPal’s terms of service and expose users to scams or fraud.

The issue has remained a trending topic on social media, with young freelancers and startup entrepreneurs expressing disappointment over lost international opportunities. Some rely on government-approved services like Payoneer, but many others admit they use PayPal under foreign aliases or through friends abroad.

In 2019 and again in 2022, speculation resurfaced about PayPal's arrival, but nothing materialized. Under pressure from the freelancer community, Junaid Ahmed Palak, then State Minister for ICT from the now-ousted Awami League government, had pledged in 2023 that PayPal would launch in Bangladesh by 2025.

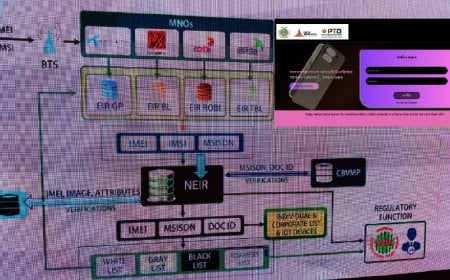

Following the political transition, Engr. Faiz Ahmad Taiyeb, now serving as Special Assistant to the Chief Advisor and overseeing the ICT Division, addressed the real reasons behind PayPal’s absence. “The previous administration made high-profile trips to the U.S. with delegations but returned empty-handed. The core issues remain unresolved,” he said. According to him, rigid financial policies, lack of proper address verification, inactivity from PayPal’s India office, and the absence of real-time financial settlement mechanisms have prevented PayPal from launching in Bangladesh.

Mir Mahbubur Rahman Snigho, brother of slain freelancer Mugdha—killed during the July uprising—publicly tagged Taiyeb in an open letter on social media. As a former executive of the July Foundation, Mir Snigho wrote, “Due to PayPal's unavailability, we lose out on countless international opportunities. Even when clients outside marketplaces want to hire us, we have to decline. Those working within marketplaces also suffer from high platform commissions, limiting both their earnings and the country’s economic potential.”

However, Syed Almas Kabir, former president of BASIS (Bangladesh Association of Software and Information Services), dismissed these concerns. He argued that PayPal's remittance platform Xoom is active in Bangladesh, allowing easy fund transfers. “We confirmed this directly with a PayPal VP. Besides, local freelancers have Payoneer, Mastercard’s Shadhin card (launched with Bank Asia), and ERQ accounts in various banks to bring funds home,” Kabir said.

He pointed out that Bangladesh Bank’s restrictions on outbound dollar transfers remain the biggest obstacle. “Countries like Nepal and Sri Lanka have PayPal. But Bangladesh lacks adequate foreign reserves—unless that crosses $75 billion, liberalizing outbound payments would be suicidal. PayPal demands real-time 24/7 automated settlement and physical customer verification. Our systems just aren’t ready,” he said.

Rupayan Chowdhury, CEO of Synesis IT Group, also attempted to delve deeper into the issue. “Xoom only supports remittances from 37 countries. Major economies like Australia, New Zealand, Japan, South Korea, Switzerland, and Singapore aren’t supported. Freelancers often lose clients because the clients are unfamiliar with alternatives. In a red-ocean market like freelancing, delay equals lost opportunity,” he said, emphasizing that if PayPal does come, it could significantly boost the economy.

Dr. Tanziba Rahman, President of the Bangladesh Freelancer Development Association (BFDA), noted that the largest freelance marketplace—Upwork—is deeply integrated with PayPal. “Xoom is available, but clients don’t use it for payments. And alternative methods often cost 5% more,” she said.

Tanvir Ibrahim, President of the Bangladesh Association of Contact Center and Outsourcing (BACCO), echoed similar sentiments. He explained that many Bangladeshi BPO companies and freelancers lose business due to PayPal’s absence, are forced to use complex and expensive alternatives, and see diminished earnings. He also warned of “brain drain” as skilled freelancers seek better facilities abroad.

However, not everyone sees this as a crisis. Tech entrepreneur Zakaria Swapan downplayed the issue, saying, “PayPal is a useful platform, but its absence isn’t catastrophic. There are now many cost-effective and technologically advanced alternatives. PayPal also charges higher fees for cross-border payments. Freelancers targeting the U.S. and EU can easily use Payoneer or PriyoPay, which even offers U.S. bank accounts and MasterCards from Bangladesh. The landscape is evolving rapidly with plenty of new options.”

According to insider sources, SpaceX’s Starlink has expressed interest in using PayPal to collect payments from Bangladesh, and discussions have reportedly taken place at the advisor level. However, three major roadblocks to PayPal’s official launch remain unresolved.