NBR Mandates EFD Installation in Highway Restaurants to Ensure VAT Compliance

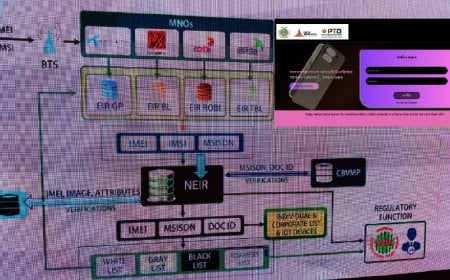

In collaboration with the National Board of Revenue (NBR), Genex IT has been working for the past few years to install and manage Electronic Fiscal Devices (EFDs), integrating all transaction data into the Integrated VAT Administration System (IVAS). Expanding this initiative, the NBR has now made it mandatory for highway restaurants—known for selling food at high prices to long-distance travelers—to install EFDs to ensure VAT compliance and boost revenue collection.

NBR’s Public Relations Officer Md. Al Amin Sheikh stated, "Due to the failure of highway restaurants to issue electronic VAT invoices, VAT is not being properly deposited into the government treasury, leading to frequent complaints from aware consumers. Many highway restaurants operate round the clock, and while some collect VAT from customers, they do not deposit it correctly. To address this, the NBR chairman has recently instructed that all highway restaurants must install EFD/SDC machines."

Following this directive, on Sunday, the VAT Implementation Division of the NBR issued a letter instructing all field-level commissioners to enforce the mandatory installation of EFD/SDC machines in highway restaurants, monitor daily transactions, and ensure the proper collection of VAT.

The NBR further emphasized that the government has undertaken various positive initiatives to keep the country's economy thriving. As part of this effort, the NBR is identifying new taxpayers, revising VAT rates, and issuing strict directives at the field level to prevent revenue evasion. Additionally, field officials have been instructed to maintain a service-oriented approach while ensuring lawful revenue collection from taxpayers.