Google Pay Gearing Up for Launch in Bangladesh

Google’s digital payment platform, Google Wallet—widely known as Google Pay—is set to be integrated into Bangladesh’s digital transaction system within the next month, according to sources familiar with the development.

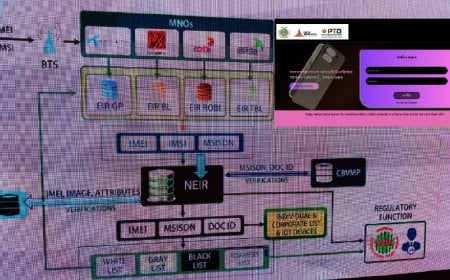

In the initial phase, customers of City Bank will be able to link their Visa and Mastercard (in Bangladeshi Taka) to Google Wallet and make payments through any NFC (Near Field Communication)-supported terminal using their Android phones. This will eliminate the need to carry physical cards. From air travel and shopping to cinema tickets, transactions will be possible entirely via mobile phones.

Sources also noted that Google Wallet does not store user data, hence it does not require direct approval from Bangladesh Bank for its operation.

Technology experts believe that, as long as users make payments through their bank accounts or debit cards, Google Wallet will not charge separate fees for regular purchases, online payments, or peer-to-peer transactions. As a result, the cost of digital transactions could be reduced by half compared to existing options.

However, they added that associated banks may deduct a fee of 1% to 3% for transactions processed through international gateways or involving foreign currency, depending on internal policies. Domestic transactions, on the other hand, are typically free of charge. “If Google processes local transactions via international servers, there may be some cases where fees are applied,” they cautioned.

A top official from the banking sector, speaking on condition of anonymity, said, “Google Wallet couldn’t be launched in Bangladesh earlier due to the lack of integration with the country’s banking infrastructure. However, demand for NFC payments among tech-savvy urban users is rapidly growing. Once introduced, users will be able to make seamless ‘tap-and-go’ payments at contactless POS terminals.”

The official further noted that the service will not only simplify retail transactions but also enhance the overall e-commerce experience in the country.