Migration Microcredit Made Easy through MyGov Platform

To make financial assistance more accessible for aspiring migrant workers, the “Migration Loan” service has been launched on the MyGov platform under a joint initiative of the Probashi Kallyan Bank and a2i (Aspire to Innovate). The service, which became effective on September 28 this year, allows applicants to apply online, undergo verification, and receive loan approval through a fully digital process. Over 100 outbound workers have already received nearly Tk 3 crore in loan support through this service.

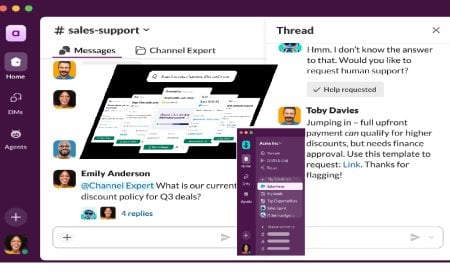

Previously, applicants had to visit bank branches multiple times, incurring extra travel costs and facing lengthy official procedures. To make the process faster, more transparent, and citizen-friendly, the service has been digitized. Now, users can log into MyGov, select the “Migration Loan” service, fill in the required information, upload scanned copies of necessary documents, and submit their applications online. The respective bank branch conducts verification digitally, and upon approval, the funds are directly deposited into the applicant’s bank account. Thanks to the integrated MyGov-bank tracking system, loan approval now takes an average of just seven working days, saving applicants both time and money while significantly reducing bureaucratic hassles.

Applicants must upload a passport-size photograph, copies of their passport, visa, BMET card, and national ID along with their application. For guarantors, copies of the national ID, citizenship certificate, and a photograph are required. Currently, the maximum loan limit is set at Tk 3 lakh.

According to users, the process has become more accessible, faster, and more reliable than before. The live update feature on the citizen dashboard has also improved transparency. Service recipient Rakib Ahmed shared, “To fulfill my long-cherished dream of working abroad, I registered on MyGov and applied online to the Cumilla branch of the Probashi Kallyan Bank for loan assistance. Following the platform’s step-by-step guidance, I completed all steps—from document uploads to branch appointments—smoothly. Within a few days, I received confirmation and verification calls. Now I’m preparing to go abroad legally, without depending on brokers or standing in long queues.”

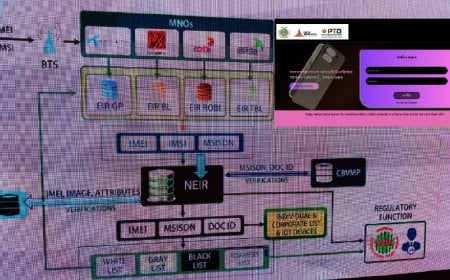

Project Director (Joint Secretary) of a2i, Md. Abdur Rafiq, said, “We plan to further automate the application process by integrating it with various national databases. In the next phase, the NID, passport, and BMET databases will be connected to the existing system.”

He further added, “Alongside the Probashi Kallyan Bank, the initiative also involves the Financial Institutions Division and the Ministry of Expatriates’ Welfare and Overseas Employment. Currently, the ‘Migration Loan’ service is available through five branches—head office, Kakrail and Keraniganj in Dhaka, as well as Manikganj and Cumilla. However, work is underway to expand it soon to the remaining 115 branches and other institutions under the Financial Institutions Division, including the Employment Bank, Bangladesh Krishi Bank, and Bangladesh Municipal Development Fund.”