Nagad Nears New Nexus: Govt Moves to Privatize Postal MFS Service

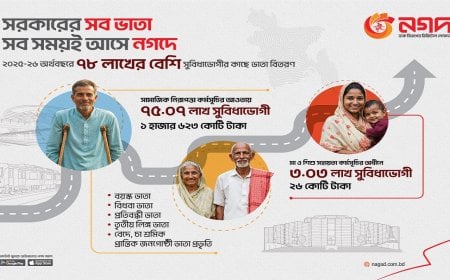

In a bid to intensify competition in the Mobile Financial Services (MFS) sector, the interim government has decided to hand over the postal department’s financial inclusion service, Nagad, entirely to the private sector.

The announcement came on August 27 at the Cashless Bangladesh Summit 2025, jointly organized by the Institute of Cost and Management Accountants of Bangladesh (ICMAB) and Mastercard at the Pan Pacific Sonargaon Hotel in Dhaka.

Bangladesh Bank Governor Ahsan H. Mansur said, “We want to create more activities and competition in the MFS sector. We have decided to privatize Nagad at the highest level and bring in investors. Probably within a week, an advertisement in this regard will be published.”

Mansur added, “Nagad will be removed from the control of the postal department, as the institution currently does not have the capacity to operate this service. Therefore, a technology company must be brought in as the main shareholder.”

Expressing optimism, he said, “I hope we will be able to revive Nagad as a strong competitor in the MFS sector.”

At the event, economist Dr. Debapriya Bhattacharya cautioned against the risks of a cashless economy, stating, “A cashless economy should not turn into an income-less economy.” Highlighting that nearly 85 percent of people in the country still depend on cash transactions, he said, “There are cyber risks in digital transactions. Even the reserves of Bangladesh Bank have been stolen, which is a major warning signal. Therefore, fraud-free and risk-free transactions must be ensured.”

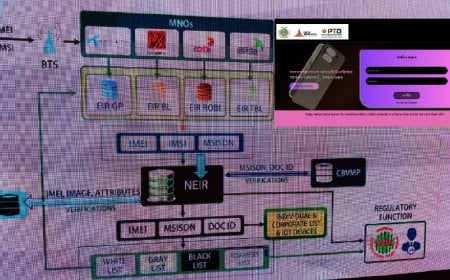

During a panel discussion, Mohammad Sharafat Ullah Khan, Director of the Payment Systems Department of Bangladesh Bank, said, “Bangladesh Bank is working to build a cashless system through digital transactions. Many people do not know how much fee they are paying for transactions. We are working in favor of making this cost transparent. To encourage customers in digital transactions, incentives will soon be introduced. However, in which format incentives will be given, it cannot be said at this moment.”

He further emphasized, “To strengthen the digital transaction system, collaboration between banks and financial institutions is essential. Otherwise, many institutions will not survive in the market.”

Other panelists included Syed Mahbubur Rahman, Managing Director and CEO of Mutual Trust Bank PLC; Ali Ahmed, Chief Commercial Officer of bKash Limited; Jakia Sultana, Director of Mastercard; and Adnan Imtiaz Halim, Chairman of Sheba Platform. The discussion was moderated by Zeeshan Kingshuk Huq, CCO of United Commercial Bank PLC, while Dr. M. Masrur Reaz, Chairman and CEO of Policy Exchange Bangladesh, presented a keynote paper.

Panelists stressed the need for banks and financial institutions to make their services faster and more accessible in order to simplify digital transactions. They also called on Bangladesh Bank to play a more proactive role in enhancing customer confidence.