Hackers Hack Islami Bank’s Facebook, Threaten Website Wreck

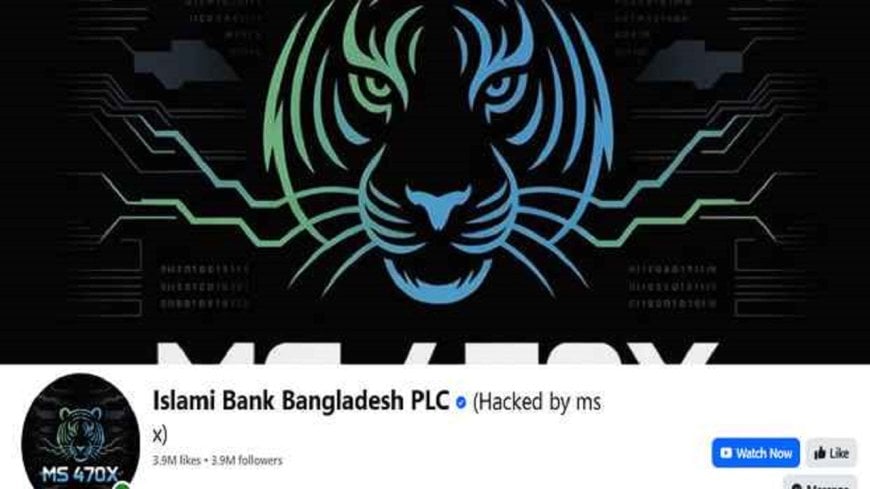

The official Facebook page of Islami Bank Bangladesh Limited was hacked in the early hours of Friday, with a hacker group named “Team MS 47OX” threatening to take control of the bank’s website as well.

At around 5:42 a.m. on October 3, the hackers posted on the bank’s verified page, declaring their control. They changed the profile and cover photos, displaying a threatening message. Although the page name remained unchanged, the hackers claimed responsibility for the attack and warned of “bigger cyber strikes” on the bank’s digital infrastructure.

The group alleged that it was monitoring the bank’s activities and would soon launch cyberattacks on both the Facebook page and website. Since the incident, customers and the general public have expressed deep concern, with many reporting unusual posts and images on the page. Some even voiced fears in the comments section regarding the safety of their accounts and transactions.

By 11:00 a.m., the Facebook link on Islami Bank’s official website was no longer functional, and the page itself could not be found through search.

Nazrul Islam, head of the bank’s public relations department, confirmed the hacking to the media, stating, “The Facebook page was hacked this morning. Our IT department is working to resolve the issue.”

Sources said that despite it being a holiday, a special cyber expert team from the bank’s IT division was working on restoring the page. One official, speaking on condition of anonymity, assured, “It is not easy for hackers to breach the bank’s website protections. Every day we block 10 to 12 thousand attacks, including DDoS attempts from inside and outside the country. The IT team is handling the situation. The hack did not compromise any internal data or customer information. Everything remains secure.”

Meanwhile, the incident comes at a time when Islami Bank has been undergoing significant restructuring. Following the ousting of the Awami League government, the bank has begun dismissing officials who were allegedly recruited through “illegal processes.” More than 200 employees have already been terminated, some of whom were recruited through bank-organized examinations. Additionally, 4,953 employees who failed to participate in evaluation tests have been made “Officers on Special Duty (OSD).” The bank has also announced new recruitment drives to fill vacancies.