Nagad Nexus: Allegations, Accountability, and Aide’s Assurance

Controversies surrounding financial irregularities, mismanagement, and leadership disputes within the mobile financial service provider Nagad continue to unfold. The evolving situation has now drawn in not only influential figures from the ousted Awami League government but also individuals currently serving in the interim administration.

Recent media reports allege the involvement of Atik Morshed, the personal aide to Faiz Ahmad Taiyeb, Special Assistant on Posts, Telecommunications, and ICT Affairs to the Chief Adviser, in corruption and embezzlement. In response, Taiyeb has publicly clarified his stance and actions, highlighting measures he has taken to ensure transparency and accountability.

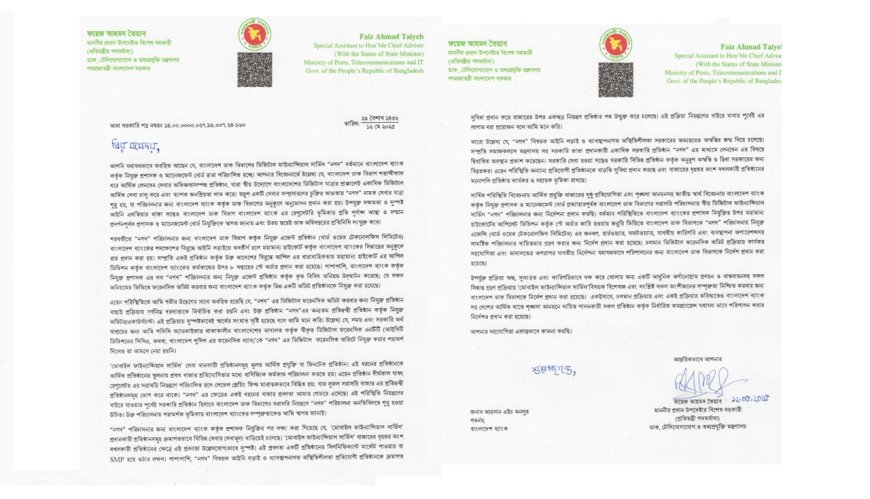

On Friday, following a tri-party forensic review of the allegations, Taiyeb stated that he instructed an investigation into the recruitment of his aide’s wife at Nagad. He also shared a letter addressed to the Governor of Bangladesh Bank via his social media account to reinforce his position.

Writing on Facebook, Taiyeb stated, “I hope the people of Bangladesh trust that I will not steal a single penny from the state or its citizens. I was raised with a strong sense of financial integrity.”

He continued, “Allegations of conflict of interest and nepotism have been raised against my personal aide. It was wrong—I admit this without hesitation. I have sternly rebuked him and initiated an investigation into the employment of his wife at Nagad. The acting CEO of Nagad will issue a press release on this matter. However, let me state clearly that dragging in former adviser Nahid Islam and myself is unjust.”

Taiyeb further wrote, “Officials from the previous government were involved in creating fake e-KYC profiles, opening accounts without e-KYC, appointing fake agents, offering fraudulent cashbacks, and conducting illicit transactions through unauthorized merchant accounts. Manab Zamin has cunningly tried to shift this blame onto Nahid Islam and me. I strongly condemn this.”

He added that the unauthorized creation of electronic money against funds held in the Transcom Settlement Account amounted to BDT 645 crore, according to a postal department report. “I personally explained this in detail to the investigating agency and delivered a presentation. I’m ready to make this public if needed. This unethical behavior has unfairly targeted us, transferring the burden of Awami-era looting onto us. I even requested to interrogate the suspect official at Nagad myself, yet the media falsely claimed I secured his release. Who will answer for such dishonest journalism?” he questioned.

Referring to a specific media claim, Taiyeb said, “The article cited misappropriation of BDT 150 crore over two months when the total expenditure was around BDT 43 crore. This is sheer misinformation and propaganda journalism, particularly painful as I have authored more than a dozen columns in that very newspaper.”

He further mentioned that the handover of Nagad's responsibility to the Bangladesh Post Office occurred on May 27. On May 28, the new acting CEO assumed office and took steps to block the email accounts of the accused to prevent confusion and threats to employees. He assured staff that no one would lose their job and that salaries and bonuses would be paid on time. Prior to this, Shafayat’s group oversaw operations for two weeks, and the Bangladesh Bank managed it from August 5 to May 11.

Taiyeb also alleged that “a faction within Bangladesh Bank had an agency publish the BDT 150 crore corruption report and had approached some TV stations earlier. The country’s top fact-checkers and digital verification experts have already exposed this.”

He added that after Bangladesh Bank appointed an administrator to Nagad, the bank commissioned a forensic audit by KPMG, despite accusations of KPMG’s affiliation with a competitor. “As a policy advisor, I opposed this and recommended using CCA or CID’s digital forensic lab for cost-effective and timely investigation,” Taiyeb explained. He also conveyed his concerns to the Governor in writing, arguing that operational control by a regulator could unfairly benefit competitors and create monopolies. “Running Nagad under the Post Office’s license with Bangladesh Bank’s oversight ensures sustainability,” he said. “I didn’t intend to disclose semi-government correspondences, but I am doing so in the interest of accountability and to protect my credibility.”

Taiyeb noted that he had tasked BFIU with measures to combat online gambling and illegal transactions by directing geo-fencing of agents at borders, and curbing fake e-KYC accounts, unauthorized agents, and illegal merchant dealings. “I have harmed no one; I’ve worked tirelessly to bring order in national interest,” he added.

“Simply put, we are trying to save Nagad from legal battles between two sides. Shafayat’s group has used heavyweight barristers to influence Bangladesh Bank. That burden is also being unfairly put on us. I have stated in the DO letter that Nagad can thrive if it’s guided by the Post Office license, regulator guidelines, and top experts. Nagad is connected to 90 million citizens—if it collapses, the financial harm to the public will be immense, and competitors will establish monopolies and hike prices,” he emphasized.

In closing, Taiyeb said, “I’m one of Manab Zamin’s columnists and have not yet claimed payment for my contributions. They have my contact number. If they wished, they could have sought a statement from Nahid Islam or me. The horror they subjected me to yesterday is unprecedented in my life. Citizens must judge the ethics of such journalism.”