At present 11 crore 15 lakh customers in the country have Mobile Financial Services (MFS) accounts. Of these, only 4 crore 10 lakh 96 thousand accounts are active; The remaining 6 crore 94 lakh accounts are inactive. This information has come up in a survey titled ’10 years of MFS: post-Corona field-reality ‘.

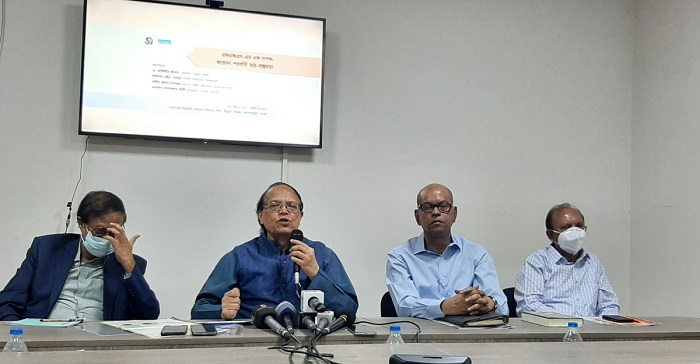

The seminar was held at the Khandaker Ibrahim Khaled Auditorium of the Unnayan Samunnoy Office at Bangla Motor in the capital on Saturday. The seminar was jointly organized by Unnayan Samunnoy and the Knowledge Alliance. Khandaker Sakhawat Ali, a sociologist and founder of the Knowledge Alliance, presented the keynote address.

The former governor of Bangladesh Bank and President of Unnayan Samunnoy, Professor Dr. Atiur Rahman; economist and executive director of the Policy Research Institute of Bangladesh Dr. Ahsan H. Mansur and Asim Kumar Dasgupta, former executive director of Bangladesh Bank were present at that time.

A survey titled ’10 years of MFS: post-Corona field-reality ‘has been conducted by talking to the general public and agents at a total of 32 points from Dhaka to Monniar Char area of Jamalpur Upazila. It was informed at the seminar that there are currently 13 mobile banking service providers in the country. However, about 60 percent of the market has been occupied by bKash, Rocket and Nagad. The rest of the companies are contributing 40 percent to the market.

BRAC Bank Chairman Dr. Ahsan H. Mansoor took part in the discussion and said that most of the people of the country should be brought under MFS. The quality of service must be increased, the cost must be reduced. A decade later, mobile banking is still limited to cash-in and cash-out; agent-dependent. This method must be changed. If you increase the usage from here without just cash in and cash out, the cost will come down a lot, you don’t even have to pay agent commission.

Asim Kumar Dasgupta, former executive director of Bangladesh Bank, said the turnover of MFS companies is between Tk 2,000 crore and Tk 2,500 crore, which is even more than many banks. Institutions need to simplify payment systems. No provider can be given the opportunity to engage in unethical practices in the market with special benefits from the government.

He further said that the government has given various benefits to a provider which is not approved by Bangladesh Bank. They are enjoying it. And even after running the business following the rules and regulations of Bangladesh Bank for the last 10 years, bKash, Rocket and Qcash are not being given benefits, it is not fare.

The former Governor of Bangladesh Bank, who was the chief guest at the event, said that when we launched MFS in Bangladesh a decade ago, the main goal was to provide easy and accessible digital financial services to low-income people living on the margins. In the Corona period, we have seen that low-income people everywhere from metropolitan areas to remote char areas have benefited from MFS. Considering that, MFS has ‘passed the Corona test’.

He added that new initiatives such as digital nano loans and micro savings are being added to mobile financial services. Priority needs to be given to taking these effectively to marginal areas like chars.